nevada estate and inheritance tax

If the sole heir is the spouse of the deceased. If the estate was placed in a trust you can avoid probate.

Estates And Trust Services 801 676 5506 Free Consultation Tax Lawyer Inheritance Tax Divorce Attorney

Even if the estate must go through probate you have options.

. Not all estates must go through probate in Nevada. An estate tax is a federal or state levy on inherited assets whose value exceeds a certain million-dollar-plus amount. For small estates up to 20000 with no real property an affidavit is all that is needed to transfer ownership of the estate.

Nevada Inheritance Laws What You Should Know

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

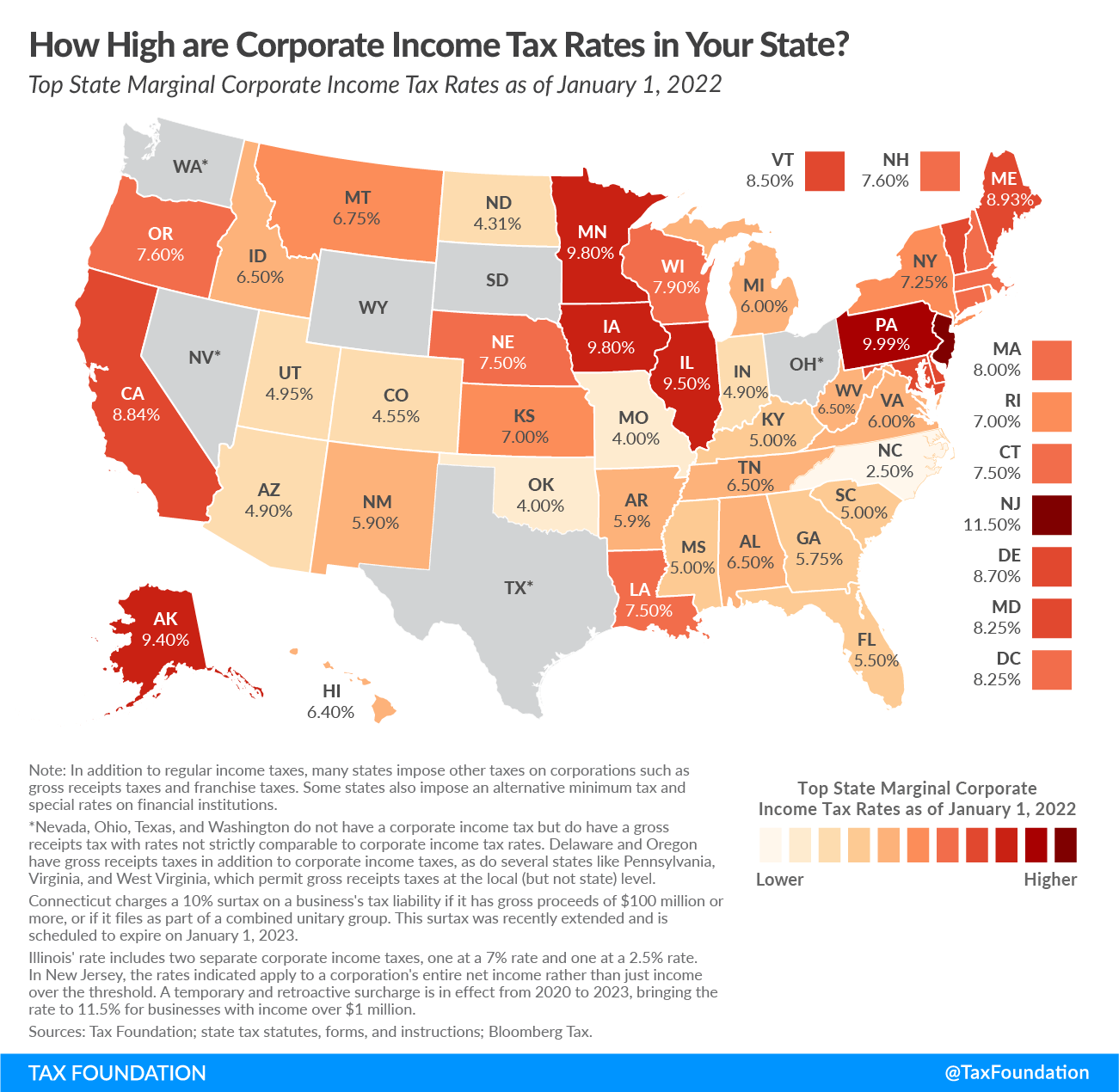

Nevada Vs California Taxes Explained Retirebetternow Com

Sample Printable Closing 0010 Disclosure Due On Sale Form Real Estate Forms Reference Letter Legal Forms

The Key Estate Planning Developments Of 2021 Wealth Management

Nevada Tax Advantages Luxury Real Estate Advisors

Property Taxes Are Not Uniform And Equal In Nevada The Nevada Independent

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada Tax Advantages And Benefits Retirebetternow Com

The Green States Do Not Tax Social Security On Retirees Kiplinger 2015 Earlygrayhair Retirement Best Places To Retire Retirement Advice

Which Us States Tweet The Most About Tesla Data Dataviz Gluuio Tesla Infographic Piktochart U S States Texas Usa Data

Nevada Income Tax Calculator Smartasset

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

State Faced Earlier Taxing Situations Las Vegas Review Journal

Incentives Nevada S Best Incentive A Pro Business Climate Site Selection Magazine